|

| New housing construction Eugene Chan/Flickr citylab.com |

The American Presidential Election season is upon us and one of the key issues that both the Republican and Democratic parties will absolutely need to address is income inequality. Specifically, income inequality and affordable housing. As each of the nominee candidates begins to articulate their positions on the subject, Tanvi Misra recently reported in CityLab on a new Brookings Institute Report which concluded that income disparities are rising in American urban centers. Her article, "The Direct Link Between Income Inequality and Affordable Housing," looks where the disparities are occurring and how it affects affordable housing. Each of the nominee candidates would be best advised to give this subject serious consideration and formulate policy proposals that will meaningfully address income inequality.

|

| Bronxdale Houses Bebeto Matthews/AP nydailynews.com |

Mr. Berube and Ms. Holmes summarized their conclusions:

Inequality is indeed high and rising in most places, with the Great Recession and subsequent lackluster recovery exacerbating already significant gaps between rich and poor households. Yet the magnitude of inequality, its source, and its trajectory vary markedly across the national landscape.

|

| Boston Waterfront Boston, Massachusetts bostonrealestate.net |

The 95/20 ratio has risen since 2007

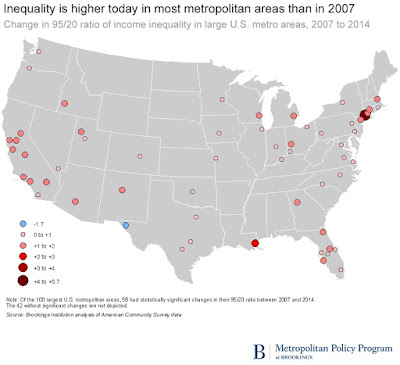

In the United States, 95/20 ratio has increased from 8.5, in 2007, to 9.3 in 2014. In short, "a household at the 95th income percentile made 9.3 times that of one at the 20th." However 57 out of the 100 largest metropolitan areas in the nation witnessed their 95/20 ratio significantly increase during the same seven year period. For example, in Bridgeport, Connecticut, the 95/20 ration experienced a 5.7 point increase between 2007 and 2014-the highest in the country.

|

| "Inequality is higher today in most metropolitan areas than in 2007" Source: Brookings Institute analysis of American Community Survey data citylab.com |

Most metro areas experienced increases because top incomes were stable or declined modestly over this period, while incomes near the bottom dropped substantially. Indeed, double-digit slides in the 20th percentile incomes were quite common across large metro areas. High-income households earned significantly less in 2014 than in 2007 in 33 of the 100 largest metro areas, but the same was true for low-income households in fully 81 of those metro areas.

The map on the left, from Brookings, showing the 58 metropolitan areas statistically substantial changes in income inequality 2007-14.

Cities tend to mirror trends in inequality as the metropolitan regions they are in. The Brookings report found that 29 out of 36 cities where the gap between rich and poor increased were located in metropolitans areas that also experienced a growth in their 95/20 ratio. Mid-sized cities like: New Haven, New Orleans, Boise, and Cincinnati experienced greater increases because the income for low-income households fell by more than an alarming 25 percent. Only Denver and El Paso experienced an earnings growth in the bottom 20th percentile between 2007 and 2014.

The relationship between inequality and affordable housing

| |

| "In More Unequal Cities, Housing is Less Affordable for Low-Income Households" Source: Brookings Institute analysis of American Community Survey data citylab.com |

Now we can answer the question of how does income inequality relate to affordable housing. To find out how the two relate, Mr. Berube and Ms. Holmes used census housing data to calculate the annual rent for housing at the 20th percentile of cost distribution in each city. This figure was compared to the annual income of the bottom 20th percentile of households in each city. One example is Washington D.C., "...the annual rent for such a rental unit was $10,286 (or $857 a month) and the annual income for low-earning households was $21,230." Therefore, the annual rent for an affordable apartment in Washington D.C. was "...48 percent of the annual income of a household that would potentially benefit from cheap housing."

For cities with higher inequality rates, this percentage was typically higher-i.e. low-income households have a harder time affording a place to live in these cities. Blogger knows what you all are thinking, if it is too expensive for low income households to live in a place like Washington D.C,, why not move to a more affordable place? As we all know, easier said than done. New Orleans and Miami, where the 95/20 ratio was a sky high 10.8 and 10.2 respectively, the lowest income earners paid up to 70 percent of their income in rent. The map above, left illustrates the relationship between inequality and rent.

|

| Cincinnati, Ohio skyline joeyblsphotography.com |

Tank Misra writes, "It's important to note that in some cities-Cincinnati, for instance-the rent burdening percentage is high even though housing there is not as expensive as elsewhere, because of extremely low incomes of the bottom 20th percentile of households." In Washington D.C,, while the incomes of the lower strata may higher in comparison to other cities, so too are the housing costs. San Francisco, on the other hand, is everyone's favorite example of lack of affordable housing but surprisingly does not have have the highest rent burden percentage (although it is 54 percent), even though its 95/20 ratio is one of the highest at 14.5 percent. At the risk of sounding like one of those people who always say, "it's not as bad as it looks, let Ms. Misra explain, "This rent-burdening percentage isn't as high as might be expected because the income of the lowest earners, at $26,400 is much higher than it is in other cities with high inequality."

Alan Berube and Natalie Holmes explain San Francisco:

That housing appears more affordable to the poor in these cities does not, however, confirm that they necessarily have sufficient affordable housing. There may be many lower-income households who would like to live in those cities, perhaps to be closer to jobs, transit, or other key services and amenities, but simply do not earn enough to afford rents there.

Now that the process of picking a new president has begun, Blogger urges everyone to go to the candidates's websites and study where each candidate stands on income inequality. Income inequality and affordable housing will be among the key issues of the 2016 Presidential Election cycle and how each candidate responds will be crucial to dealing with this challenge.

No comments:

Post a Comment